What is a Lease Guarantor?

Why do you need a lease guarantor when renting in New York City?

If you’re a first-time renter in New York City, you’ve probably run into a common roadblock: meeting landlord requirements.

Landlords want to be sure their tenants can reliably pay rent. That means they look closely at three things:

Rental history (have you rented before and paid on time?)

Credit score (do you have a record of handling debt responsibly?)

Income and savings (do you earn enough to afford the apartment comfortably?)

In NYC, these rules are notoriously strict. Most landlords require tenants to earn 40 times the monthly rent in annual income—so for a $3,000 apartment, you’d need to show at least $120,000 in yearly income. Some also ask for two years of rental history.

For many first-time renters—students, interns, or young professionals just starting out—those numbers simply don’t add up. They may have little credit history, no prior rental track record, and an entry-level salary. That leaves them in a tough spot: qualified in every personal sense, but disqualified on paper.

The Problem With Paying More Up Front

A natural question is: why not just pay extra up front to reassure the landlord?

Sometimes this works in other cities. But in New York, tenant protection laws limit how much landlords can accept in advance. Security deposits are capped at one month’s rent, and landlords cannot legally accept multiple months of rent upfront as a condition of leasing.

So while it might seem logical to offer a few months’ rent in advance, in most cases it’s not allowed. That’s why so many renters turn to guarantors.

What Exactly Is a Guarantor?

A guarantor is someone who agrees to cover the rent if you don’t. Think of them as your financial backup.

For landlords, this is a huge comfort. If you fail to pay, there’s a second person or entity they can turn to for the money. That extra layer of security makes them far more likely to approve your application.

There are two main types of guarantors:

Personal Guarantors

Usually a parent, relative, or close friend with strong credit and a high income. Landlords will check their finances closely—sometimes even more strictly than they check yours. The logic is simple: a guarantor must be able to handle both their own living expenses and your rent if needed. For many renters, this isn’t realistic. Not everyone has a family member who qualifies, and asking a friend can create uncomfortable financial entanglements.Corporate Guarantors

These are companies that act as professional guarantors. Instead of asking someone you know, you pay a fee to a business that takes on the role. The landlord gets the assurance they want, and you get approved for the apartment.

How Corporate Guarantors Work

Corporate guarantors are a relatively recent innovation in the rental market. Here’s how they work in practice:

You apply for an apartment and the landlord asks for a guarantor.

Instead of calling your parents or scrambling for a co-signer, you apply with a guarantor company.

The company evaluates your application—credit score, income, and sometimes additional background checks.

If approved, they agree to guarantee your lease.

In exchange, you pay a one-time fee, usually 25% to 120% of one month’s rent.

For example:

Rent: $2,500/month

Landlord requires a guarantor

Corporate guarantor fee: $625–$3,000 (depending on your risk profile and level of protection)

That one-time fee could be the difference between getting approved for your dream apartment and walking away empty-handed.

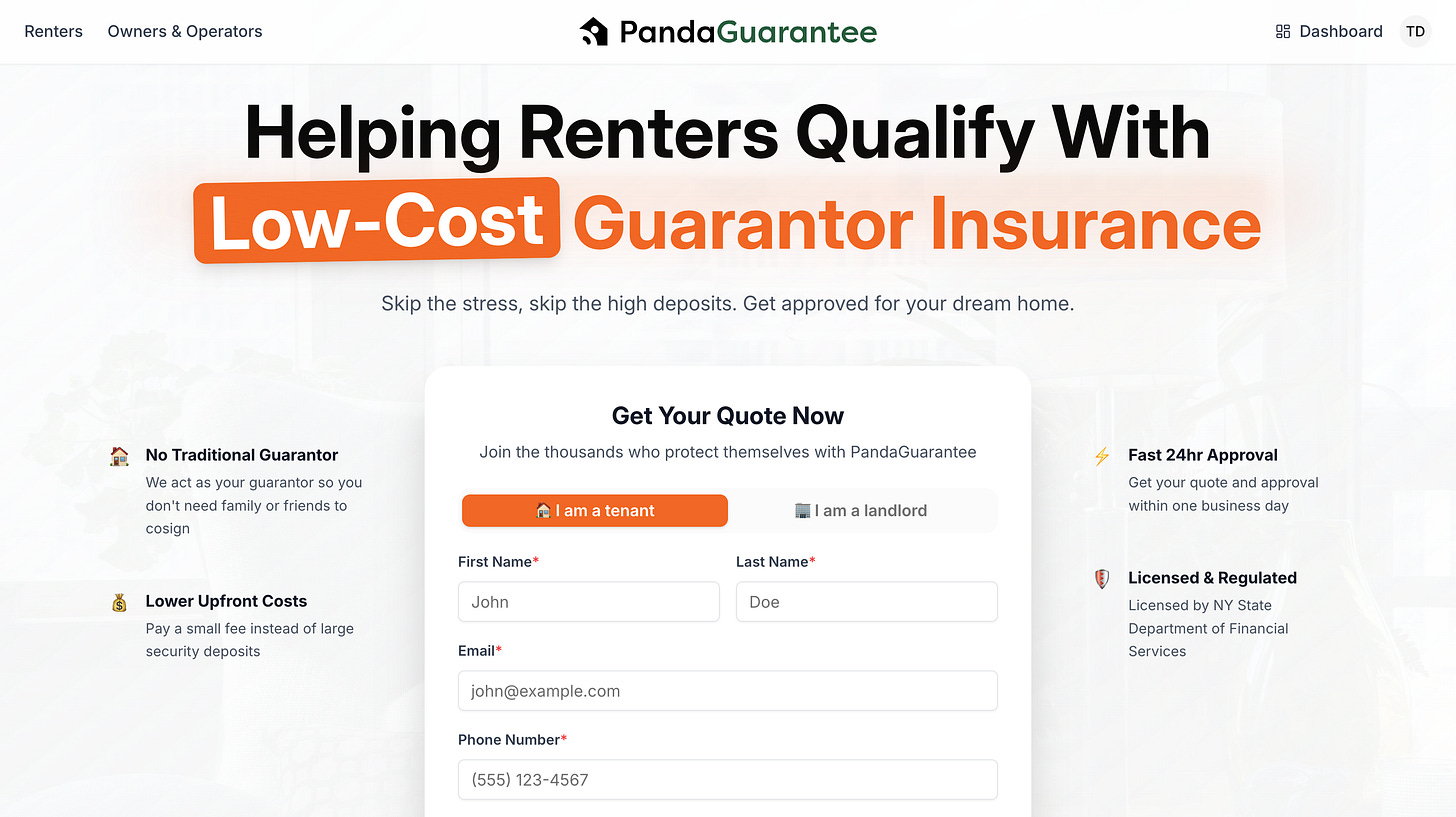

Why PandaGuarantee?

Here’s where PandaGuarantee fits in. We built PandaGuarantee to be the lowest-cost corporate guarantor in New York City.

We know that most renters who need guarantors are already stretched thin—students, young professionals, and people new to the city. Paying huge fees just to qualify doesn’t make sense. That’s why PandaGuarantee keeps costs lower than competitors while still giving landlords the confidence they need to approve your lease.

With PandaGuarantee:

You don’t need to burden family or friends.

You don’t need to offer illegal upfront rent.

You can qualify for apartments that would otherwise be out of reach.

Final Thoughts

Renting in New York can feel overwhelming. Between strict income requirements, credit checks, and rental history rules, many qualified tenants are left out in the cold.

A guarantor—whether personal or corporate—can bridge that gap. And if a personal guarantor isn’t an option for you, a corporate guarantor like PandaGuarantee can be the key to unlocking your next home.

If you’re looking for a guarantor that’s affordable, transparent, and designed with renters in mind, sign up with PandaGuarantee today.